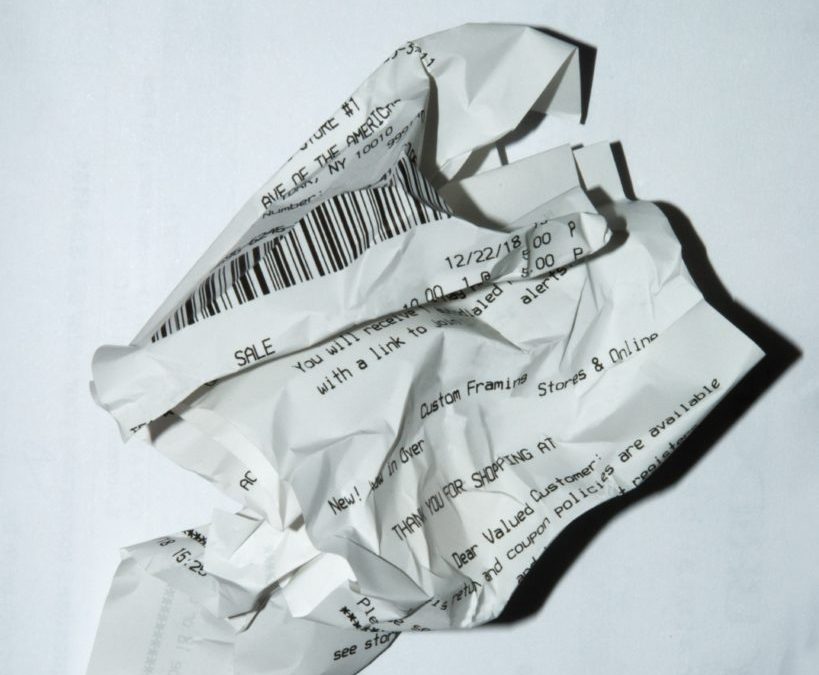

Receipts. You get them all the time – for every little purchase you make.

You’ve been told to keep them, but why? Your accountant doesn’t request them at tax time, and they just end up creating obnoxious piles in your car, on your desk, on your dining table… everywhere.

Here’s my advice. KEEP THEM.

If the IRS ever comes knocking, you better believe they’ll be asking for documented proof of the business expenses you claimed a deduction for.

Instead of letting those little paper slips stack up in dusty piles of “I’ll deal with it later,” take advantage of the cloud.

Why?

Paper gets lost, ink fades, and mis-filing (or no filing) happens.

Instead, snap a picture of your receipts and virtually file them as soon as that paper enters your hands (or your e-receipt hits your inbox). There are many free or affordable cloud-storage options available, making this super easy to do.

Better yet, attach your receipts directly to their related transactions in your accounting software (Wave, QuickBooks Online, and Xero all have this capacity). This allows you to reflect on the details of your expenses, and show them to whoever needs to see, without breaking a sweat.

If you really just don’t want to be bothered, ship your #receipts off to your #bookkeeper for them to deal with. And done.

Recent Comments